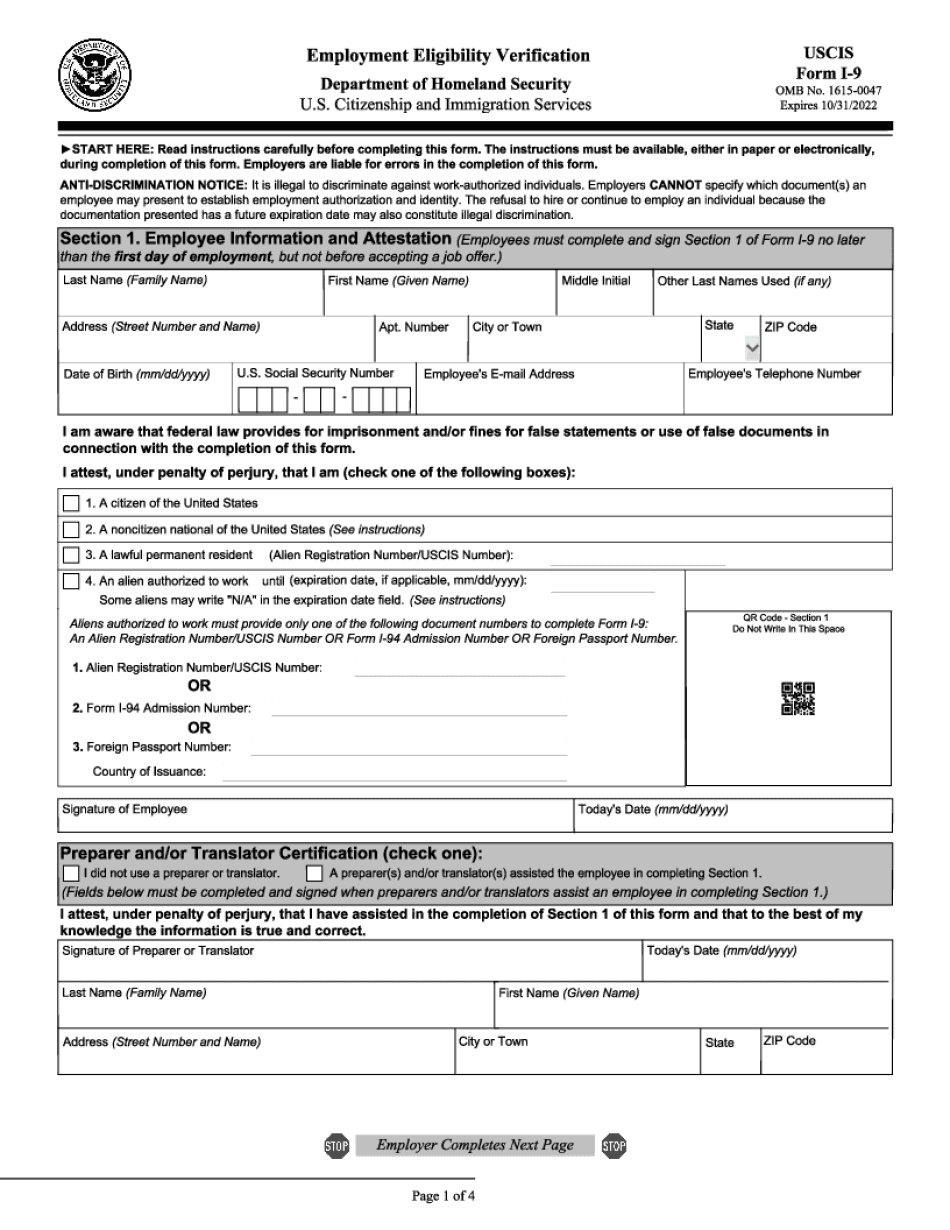

You know, did I tell you about the new client I went to on the East Coast? Sure, I'll tell you what. I asked him about his ionized and he said they're perfect. I said they're perfect. Perfect. Harvester Steve said they're never perfect. Pacific mine, you're perfect. So how did you get to be perfect? He said, "Well, that was really simple." He said it cost me fifty-two thousand dollars in fines from Homeland Security. Oh my god, that's a lot of money. He has a lot of money. So I tell you what, folks, that's a reality and now that's a true story, okay? And I would suggest you listen real hard to Harvester Steve. He's gonna help us to learn how the Phillies formed out correctly. I think the first question, what is an i-9 form? The i-9 form is a legal document that has to be completed by every employer and employee in the country, so it's a federal requirement, just like a driver's license is required to drive a vehicle. We have to have this form every employee hired after November 6, 1986, to make sure they're authorized to work in the country. That's what it is and why it has to be done. So we know what it is, we know why we have to have it. Maybe a little bit bureaucratic, but it's part of the law, everybody. So, I'm just going to walk you through some key points here that help you guys complete Ryan ions correctly. First thing I want to do is make sure you have the right i-9 form. Look in the bottom left corner, make sure it says 07/17/17. That's the publication date, that's the one you want to have because a lot of people use old i9 forms,...

Award-winning PDF software

How to Fill I-9 Form: What You Should Know

Dec 28, 2025 — Applicant's Signature; Applicant's date of birth; Number of employment; Date of birth or date last employment [this is used to determine age] How to Fill Out Form I-9 (for a Nonimmigrant) I-9 — Nonimmigrant Visa Dec 2, 2025 — Issuance (of Form I-551, Application for Nonimmigrant Visa) [This is the form that will request an employee's information and authorization to work in the United States] How to Fill Out an I-9 (for a Nonimmigrant) — Investopedia How to Fill Out Form I-9 (for a Nonimmigrant) — Investopedia How you can fill out the I-9 form once you have your own employment authorization (see Step #3) Dec 3, 2025 — I-9 Form; Title of employer; State of issuance; Citizenship of beneficiary [This is used to determine nationality of employee] How to Fill Out an I-9 — Nonimmigrant Visa [for an American Citizen] How to Fill Out Form I-9 — Nonimmigrant Visa [- Video Instructions] FILLING OUT ONE FORM Step #1 — Identifying information The first question for a U.S. employer is to determine if the employee is a U.S. citizen. The employee must give to the employee's new employer that information that he or she will need to file Form I-9. As the new employer, you must fill out the I-9 form from the U.S. Citizenship and Immigration Services. Step #2 — Authorization to work in the United States The new employee now needs to fill out the form. The information that the employee needs is a valid social security number. Step #3 — Entering the employee's information Once an I-9 (and visa/green card) is filed, the new I-9 employee has to pay a fee of 575. (If the employer is a company that has been in U.S. business as of two years prior to filing the I-9) Step #4 — Authorization to work in the United States The I-9 employee now needs to enter the employee's information onto the Form I-9. On the Form I-9, the employee must attach a photograph and a valid social security number. The I-9 must be made to indicate the date of birth and the name(s) of the employer.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do I-9 , steer clear of blunders along with furnish it in a timely manner:

How to complete any I-9 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your I-9 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your I-9 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to Fill I-9 Form